lok sabha bill (Credit: OpenAI)

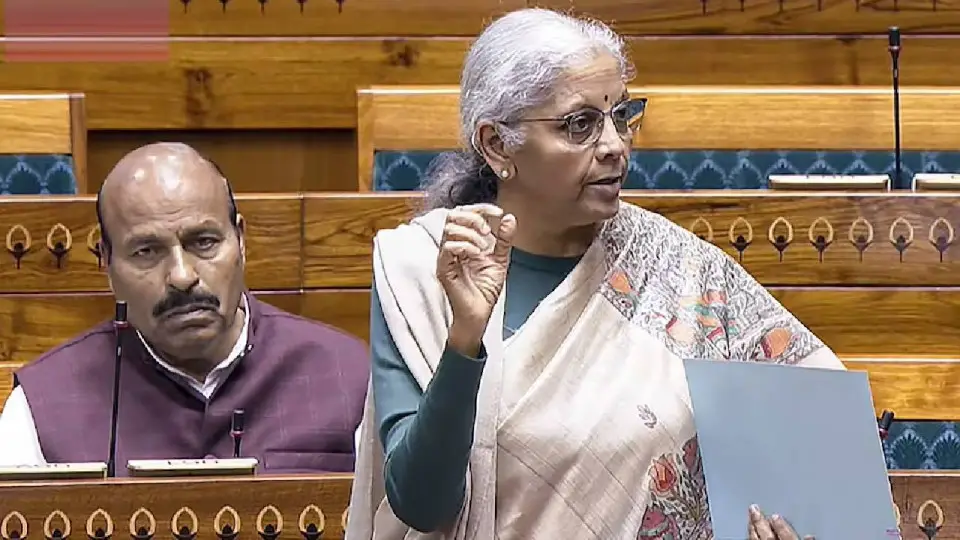

New Delhi: Lok Sabha passed a new tax called the Health Security to National Security Cess. This tax will increase the price of products that harm people’s health. Cigarettes, gutkha, and pan masala will become costly once this law starts. The aim is to reduce the use of such harmful products. Government says people must think before buying things that damage the body. After long debate the bill was approved. The finance minister said money collected will go only to defence and health needs. This decision is one step towards a safer India.

Finance Minister Nirmala Sitharaman explained that defence needs modern machines. High-tech warfare is very expensive today. Cyber tools, missile systems, and space equipment need strong budget. She said India suffered during the Kargil conflict because of low stock of weapons. The army had only 70 to 80 percent of required ammunition. India never wants that again. This tax will build stronger defence support. Soldiers will get better equipment for protection. The focus is national safety without delay.

The minister said this tax is not on daily-use items. It applies only to products which damage health. Ordinary people will not face extra cost for necessary things. Families will not suffer because of this law. When harmful products become costly, people reduce their usage. Good habits increase and medical expenses reduce. The government wants society to stay healthy and strong. This plan tries to protect both the pocket and health of citizens.

Money collected from this tax will improve hospitals and medical systems. It can help in more medicines, better machines, and more doctors. Government wants public health to grow stronger in every state. If people stay healthy the nation grows fast. The aim is to reduce sickness. Parliament will decide how much money will be spent and where it will go. Better health facilities mean less stress in emergencies. A healthy nation supports stronger security.

Some opposition MPs like Hanuman Beniwal opposed the bill. They asked why celebrity ads of harmful products are still allowed. They said tax alone cannot solve health problems. Congress MP Shashikant Senthil said some sections need more clarity. They demanded the government take stronger action against promotion of bad items. Opposition wanted the bill to be withdrawn. But after two days of arguments the bill passed with majority support. Government stood firm on the decision.

The finance minister said the cess is fully controlled by Parliament. Tax rates and spending plans will be approved only inside the House. Section 7 explains the whole structure. There will be transparency and clear rules. No secret decisions will be taken. Citizens must know where their money is used. This tax system will support defence without hurting common families. Parliament will monitor every step for accountability.

Minister said harmful items should not stay cheap. Bad habits damage health and increase hospital cost. If people choose these products they must pay more. Money earned from bad items will now help protect the country. Government wants right habits to grow. This cess supports both security and health together. The aim is simple -safe people and safe nation. Better choices will build a stronger India.

Copyright © 2025 Top Indian News